Barbora Hinnerova

SOLUTIONS

6 MINS READ

How to Analyze EV Fast-Charging Station Locations for Network Expansion

See how mobility data and POI models support site selection, catchment analysis, and retail expansion, and understand when each dataset delivers the most value.

Why Location Analysis Should Come First in EV Fast Charging Expansion

Expanding an EV fast-charging network is a high-stakes decision. Each new station represents a significant investment in construction, grid connection, technology, land agreements, and long-term operations.

When a location underperforms, utilization remains low. Return on investment stretches over many years. Rollout plans slow down. These are not issues that can be fixed later at low cost.

That is why location analysis needs to come before expansion, not after.

Different types of EV charging have specific location requirements. High-power charging is designed for long-distance travel rather than short urban trips. Demand depends on real mobility patterns, accessibility to major roads, surrounding services, and competitive pressure.

This article focuses specifically on EV fast-charging infrastructure designed for corridor and high-traffic locations. At CleverMaps, we approach this challenge with a unified, data-based framework that evaluates every potential location using the same logic and the same criteria.

Why data matters in fast-charging expansion

Choosing locations without a consistent analytical framework leads to inconsistent decisions. Different teams prioritize different factors. Results are difficult to compare and even harder to scale across regions or countries.

A structured analytical approach reduces risk by making the decision process transparent and clearly showing why a location was selected or rejected. It creates a reliable foundation for investment planning and ensures that new charging hubs are placed where they are most likely to perform well.

What the cooperation on EV fast-charging stations with CleverMaps delivers

The goal is not a one-off analysis. The goal is a repeatable framework for long-term expansion. By working with CleverMaps, the Location Intelligence platform, expansion teams gain:

A consistent methodology for evaluating charging locations

A way to combine internal charging and electricity sales data with external datasets

Clear insight into traffic flows, accessibility, competition, POI attractiveness, and demographics

A shortlist of the first high-potential hub locationsAn interactive environment for ongoing planning

A model that can later be extended to other countries

This creates a scalable and transparent basis for decision-making, allowing expansion teams to prioritize investments with greater confidence and consistency.

How POI data fits into the analysis of EV fast-charging station locations

Traffic flows and road accessibility explain how drivers move, while Points of Interest indicate where they are likely to stop and why.

For fast charging, this distinction is important. Charging sessions are long enough that drivers expect to use the time productively. For example eating, shopping, or resting. Locations surrounded by relevant services are therefore more attractive than isolated sites, even if traffic volumes are similar.

POI data describes places people actually visit, including retail, food, services, and leisure destinations. Beyond location and category, it can also reflect how active and attractive these places are.

In our analyses, we use POI datasets in the form of CleverMaps’ unique Business Attractiveness, a POI-based model that estimates the average number of visitors per day based on a location’s attractiveness.

POI data enriches location data with behavioral indicators such as popularity, showing how frequently places are visited, and their sentiment, reflecting how people evaluate specific locations based on aggregated digital content.

Within CleverMaps, this enriched POI data is integrated into spatial analysis and scoring models alongside traffic, accessibility, and competition. This helps distinguish between locations that may appear similar based on traffic alone but differ significantly in usability and expected utilization.

Mobility analysis for EV fast-charging stations based on traffic data from TomTom

Mobility analysis is a core component of EV fast-charging site selection. Fast chargers primarily serve long-distance travel, where demand concentrates along major transport corridors rather than local or residential streets.

To reflect this reality, we use traffic data from TomTom to analyze observed vehicle movement instead of estimates or theoretical models. The dataset provides anonymized traffic volumes, allowing us to evaluate how vehicles move across the road network and how many pass through specific areas.

Mobility data helps compare potential locations, identify key transport corridors suitable for fast charging, and validate shortlisted sites using observed vehicle counts.

Traffic analysis focuses on higher-level roads that represent long-distance travel, while lower road classes are typically excluded because they reflect local movement with limited demand for fast charging.

We usually recommend analyzing one representative time period, such as a single month, which provides reliable average daily profiles and supports consistent comparison across locations.

Mobility data is always evaluated together with POI, accessibility, competition, and demographic layers rather than in isolation.

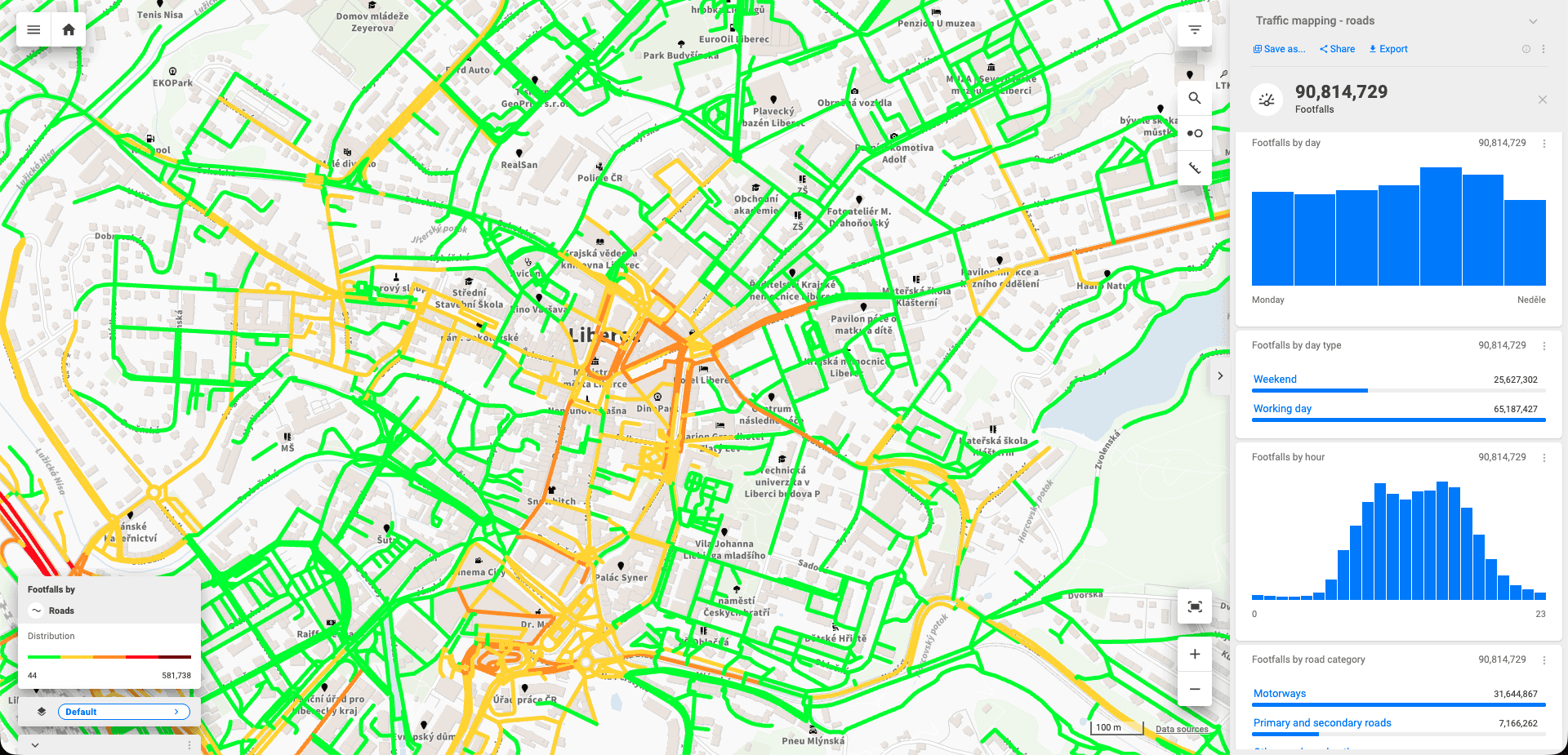

Location analysis visualized in CleverMaps Studio.

How to conduct location analysis for EV fast-charging network expansion in 5 steps

Step 1: Data preparation and integration

Everything starts with data. We integrate internal and external datasets into a single spatial framework so that every area can be analyzed consistently.

Internal data typically includes the existing charging network and charging consumption or electricity sales data. This shows how the current network performs and where demand already exists.

External data adds context. It commonly includes traffic statistics, road networks and highway exits, points of interest, competitor charging networks, and demographic indicators.

By combining these inputs, each zone can be evaluated from mobility, accessibility, commercial, and competitive perspectives.

Step 2: A custom scoring model for fast charging

Raw data does not guide decisions on its own. It needs to be translated into a scoring model that reflects real charging behaviour.

We design a scoring methodology tailored specifically to fast EV charging. It can include factors such as traffic intensity, accessibility to major roads and exits, proximity to relevant services, competitor density, and demographic or commercial context.

Each factor contributes to the final score. The weighting reflects how strongly it influences expected utilization.

This makes trade-offs explicit and decisions easier to explain.

Step 3: Spatial analysis using an H3 grid

All results are visualized in a consistent spatial grid inside CleverMaps. This makes it possible to compare locations across the entire country using the same spatial units.

Teams can explore colour-coded opportunity areas, view existing and competing charging networks, and combine traffic, accessibility, POI, and commercial layers in one place.

This makes location patterns and opportunities easier to understand than when working with tables or spreadsheets alone.

Step 4: Pre-selected recommended locations

Based on the scoring model and spatial analysis, we prepare a shortlist of the most suitable locations.

Each recommended site includes its scoring results, traffic and accessibility context, and competitive pressure. This gives expansion teams a clear basis for prioritizing investments and planning rollout phases.

Step 5: Delivery in the CleverMaps platform

All outputs are delivered in an interactive environment designed for expansion and investment teams. The final workspace includes:

The full EV fast-charging scoring methodology

An H3 grid opportunity map

A shortlist of recommended locations

Integrated traffic and POI data

All datasets available for reuse in future projects

An EV fast-charging network framework built for scale

This approach does not end with one market or one rollout phase. It creates a repeatable, long-term framework that supports confident expansion and can be extended to any markets.

For fast EV charging networks, this means lower risk per site, clearer investment decisions, and infrastructure built where drivers actually travel and stop.

If you are planning to expand your charging network, CleverMaps can help you evaluate locations with a consistent, data-based methodology.